- ABOUT US

- CARGO

- PASSENGERS

- MULTIMODALITY

- ECOLOGICAL TRANSITION

- INNOVATION

A maritime traffic up despite an unstable international context

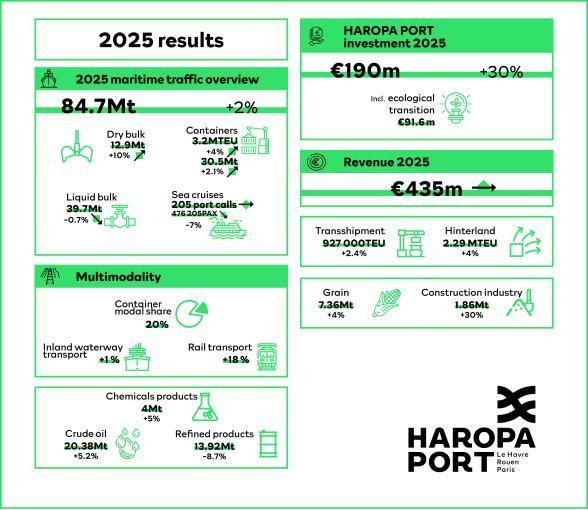

In 2025, total maritime traffic reached 84.7 million tonnes, an increase of 2% compared with the previous year:

- Container traffic reached a historic level of 3.2 million TEU, up 4%, marking an unprecedented threshold on the Seine corridor,

- Solid bulk returned to growth with total traffic of 12.92 Mt, up 10% year-on-year. The grain sector closed the year at 7.36 Mt (+4%), and aggregates reached 1.86 Mt (+30%),

- Liquid bulk totalled 39.7 Mt in 2025, a stable result compared with 2024. This performance was driven by a 5% increase in crude oil (20.38 Mt) and 5% growth in chemicals, reaching 4 Mt. Refined products declined by 9%, reflecting the very strong activity levels of the two refineries on the Seine axis supplying national demand,

- Ro-ro traffic was the only segment to decline, down 9.2% in 2025, with more than 242,000 vehicles handled at the Le Havre ro-ro terminal. A rebound was nevertheless observed in recent months,

- As for maritime cruises, the number of calls remained stable in 2025 after several years of growth: 205 cruise ships called at HAROPA PORT, compared with 206 in 2024, and 476,205 passengers transited through the port.

Container traffic: a new record on the Seine corridor in 2025

Despite a shifting international shipping environment, container traffic continued to grow, rising by 4% and setting a new record for HAROPA PORT, with more than 3.2 million TEU handled during the year.

This performance reflects a slight 2.4% increase in transhipment, and a record hinterland traffic of 2.3 million TEU, up 4%.

The reorganisation of shipping alliances at the beginning of 2025 strengthened HAROPA PORT’s positioning on the main regular shipping services along the major Asia–Europe and Europe–America routes. All alliances continue to serve HAROPA PORT, and three shipping lines – MSC, CMA CGM and Hapag-Lloyd – are shareholders in maritime terminals in Le Havre.

The year was also marked by the completion of major private investments in Le Havre terminals, demonstrating confidence in HAROPA PORT’s development strategy and in the opportunities offered by the Seine corridor.

TiL-MSC terminals received the four final cranes from the order of nine mega-cranes placed by the operator, bringing its total investment at Port 2000 to nearly €1 billion. These new units, the largest in the world, will be commissioned in the coming weeks, enabling optimised handling. To find out more

In March, Hanseatic Global Terminals (HGT), a subsidiary of Hapag-Lloyd, became the majority shareholder of the Nord terminals operator, now renamed HGT Le Havre, alongside SEAFRIGO Group. This partnership strengthens the presence of the world’s fifth-largest shipping line in Le Havre. To find out more

An exceptional grain campaign

In the grain sector, HAROPA PORT closed 2025 at 7.36 Mt, up 4%, with two very different halves of the year.

The first half was weaker, at 3.05 Mt, while the second half was particularly strong, reaching 4.31 Mt. This second half (the first half of the 2025/2026 campaign) represents the second-best campaign start of the past 10 years, after the 5 Mt recorded in 2022/2023.

For soft wheat, key destinations included Morocco, the European Union and West Africa, as well as other markets such as Egypt.

2025 also marked the start of construction of a new silo for the BZ Group, which is expected to be operational for the next campaign. These works were supported by the extension of the Petit-Couronne quay, carried out by HAROPA PORT. To find out more

A strengthening multimodal activity

At the heart of HAROPA PORT’s strategy, modal share now exceeds 20%

HAROPA PORT has made multimodality a priority to meet the challenge of decarbonising port activities. On the Seine corridor, modal share continued to grow in 2025, with the modal share reaching 20.3%, in line with the objectives set in the 2020–2025 strategic plan (19.7% in 2024).

In volume terms:

- River container traffic measured at the Paris-region terminals remained stable (+1%) after several record years.

- A new all-time high was reached for rail container transport in Le Havre, with 145,000 TEU moved by train to and from the hinterland, an increase of 18%, notably thanks to the launch of a new service to Tours and the strengthening of links to Valenton, Vierzon and Clermont-Ferrand.

To support this momentum:

- HAROPA PORT and SNCF Réseau signed an ambitious memorandum of understanding to optimise rail services and support the transition towards this more sustainable mode of transport.

- For inland waterways, HAROPA PORT partnered with Entente Axe Seine and Voies Navigables de France (VNF) to define measures supporting river logistics and give new impetus to the Seine corridor.

This joint initiative is already taking shape through the arrival of Urban Logistics Solutions (ULS), which signed a temporary occupancy agreement last October to develop urban river logistics from the port of Charenton-le-Pont to Paris.

In Rouen, ULS has also been selected for the Promenade de la France Libre site. In June, HAROPA PORT began quay reinforcement works on the right bank, upstream of the Guillaume-le-Conquérant bridge, to accommodate this new activity under optimal conditions.

Stable revenue

Preliminary revenue for 2025 stands at €435 million, compared with €436 million in 2024, which was a record year. This stability was achieved in a context marked by external factors, including technical shutdowns at refineries and a weak first half of 2025 linked to reduced port dues on grain (a consequence of a poor harvest).